Headline inflation is expected to remain within the government’s 2 to 4 percent target in May.

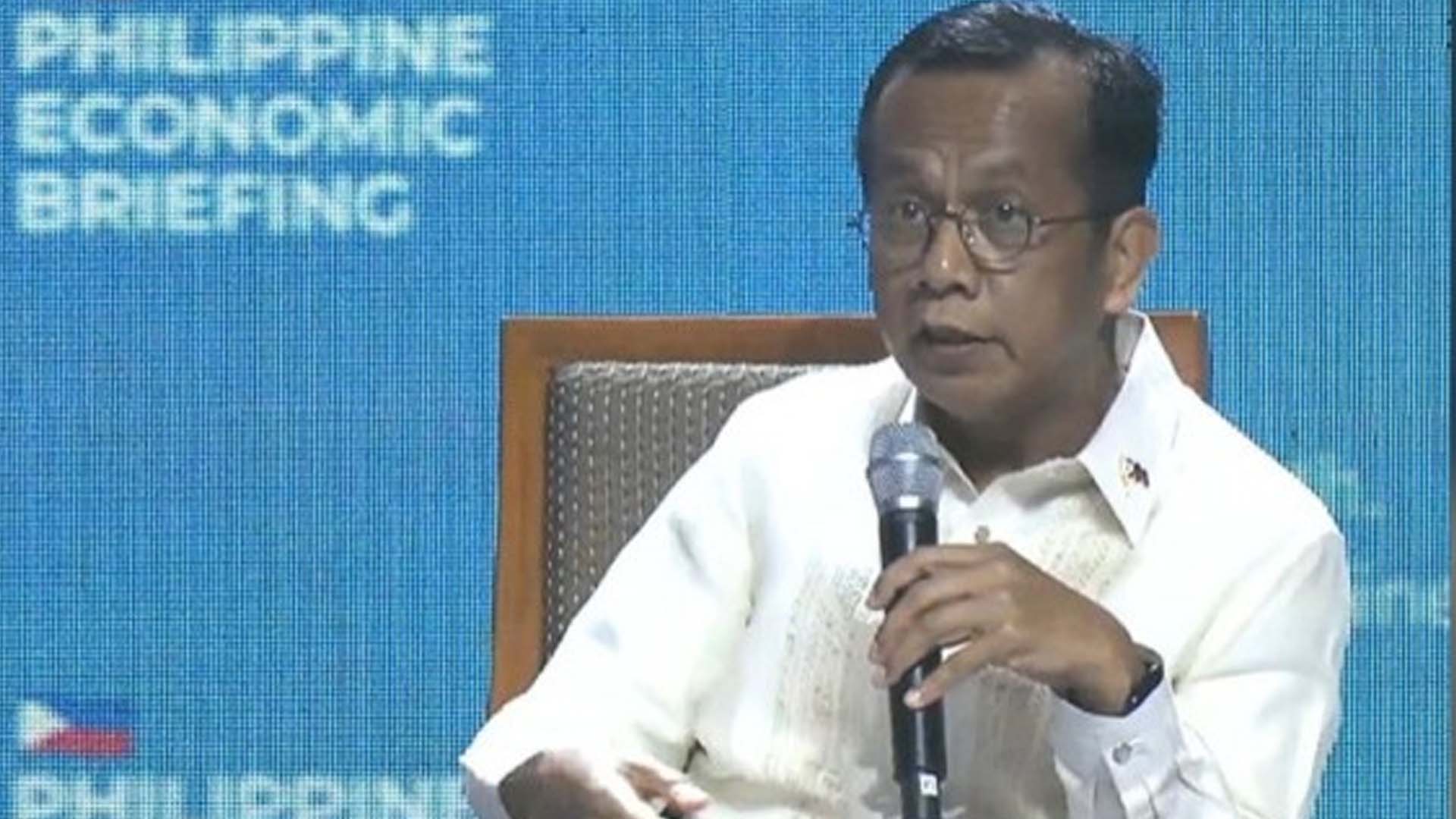

“We are still aiming for 2 to 4 percent, the target for the year. I think that we should be there,” National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan said on the sidelines of the Philippine Economic Briefing at the Philippine International Convention Center in Pasay City on Monday.

Headline inflation settled at 3.8 percent in April, which is at the higher end of the government’s target.

“It [May inflation] can be lower or it can be higher than 3.8 [percent], but we expect to be in that range,” Balisacan said.

A report released by the Bangko Sentral ng Pilipinas (BSP) on Monday also showed that analysts expect headline inflation to remain within the target range this year, although settling at the upper end of the target range as uncertainty lingers.

The BSP’s Monetary Policy May 2024 report showed that preliminary results of the BSP’s survey of external forecasters (BSEF) for this month showed that the mean inflation forecast for 2024 eased from 3.8 percent in April 2024 to 3.7 percent this month.

Mean forecasts for 2025 were unchanged at 3.5 percent but were higher for 2026 from 3.4 percent to 3.5 percent.

The BSP said analysts believe that upside risks continue to dominate due mainly to supply chain disruptions.

These include elevated prices of basic goods particularly oil and food, including rice owing to supply-side pressures brought by the geopolitical conflict in the Middle East; adverse impact of El Niño; and potential negative effect of La Niña in the second half of the year.

“Meanwhile, a few analysts cited downside risks from easing albeit still elevated food and non-food inflation, such as rice and oil; and waning inflationary pressures on prices as El Niño and base effects weaken in the near term,” the report said.

Rice prices

Economic managers, however, believe that rice prices will decline starting September this year.

“We expect rice prices to go down by 20 percent, maybe by September. This would entail one, increasing production and second, reducing tariffs,” Finance Secretary Ralph Recto said during the panel discussion at the PEB.

Balisacan, for his part, also believes that rice prices will start to decline in the latter part of the year.

“Well, the forecast on global rice prices by the second half of the year, particularly by September, is going down. It’s already past El Niño and the election in India is over, so all those restrictions and exports of major exporting countries are expected to loosen,” he said.

Balisacan said global supply and production are also expected to increase.

“So that’s the forecast. So, as I said, the domestic prices simply reflect the trends in global prices, particularly for rice. So, as global prices come down, and provided our exchange rate will not sharply depreciate, which I don’t expect, then we should see domestic prices coming down,” he added. (PNA)