The growing role that fintech is playing within the Philippines’ financial services industry and across the broader economy as the government’s digital transformation drive gathers momentum was high on the agenda at a VIP event organised jointly by the global research and advisory firm Oxford Business Group (OBG)and its legal partner, Villaraza & Angangco (V&A) Law.

Titled “The Financial Paradigm Shift: Fintech and the Future of Philippine Monetary Policy”, the closed-door gathering on January 28 at the Rainmakers Lounge, V&A Law Center, brought together high-profile representatives from a cross-section of the business community to discuss the pace at which fintech is being adopted nationally against a backdrop of robust economic growth.

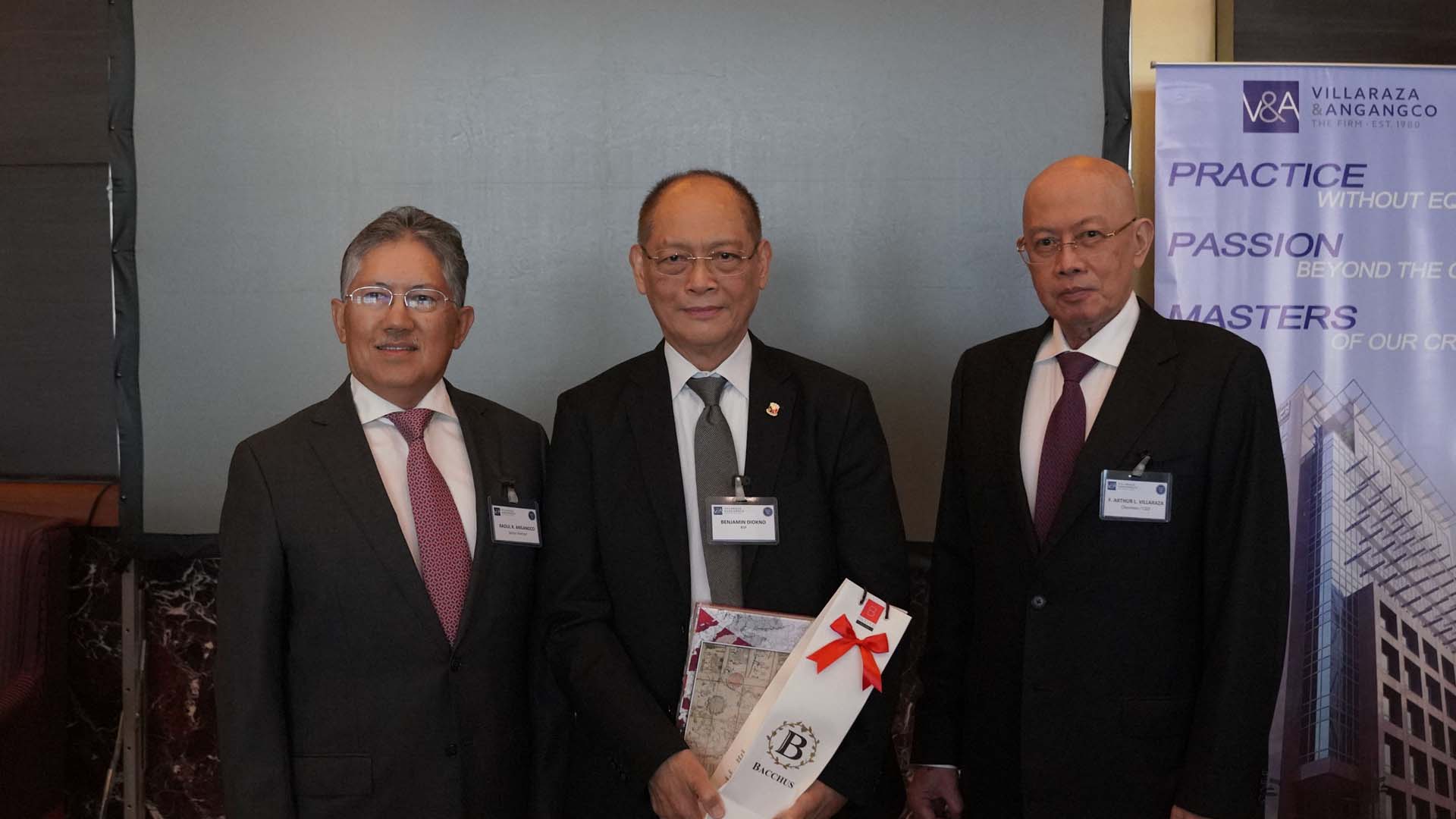

Atty. Alejandro Alfonso E. Navarro, Managing Partner of V&A Law, welcomed guests, after which Benjamin E. Diokno, Governor of the Bangko Sentral ng Pilipinas (BSP), gave a keynote speech. Presentations were also made by Patrick Cooke, OBG’s Regional Editor for Asia, and Alejandro Jalon, the Group’s Editorial Manager in the Philippines.

Attendees included: Atty. F. Arthur L. Villaraza, Chairman and CEO of V&A Law; Atty. Raoul R. Angangco, Name Partner of V&A Law; Helen Y. Dee, Chairperson of Rizal Commercial Banking Corp (RCBC); Cesar E. Virata, Corporate Vice Chairman of RCBC; Protacio Tacandong, COO of Reyes Tacandong & Co; Simoun Ung, President & CEO of Omnipay; Richard Bates, President & CEO of Manulife; Lynette Ortiz, CEO of Standard Chartered; and John Januszczak, CEO of UBX.

In his speech, Governor Diokno highlighted the way in which fintech, and digital payment platforms in particular, are disrupting the financial services industry, telling the audience that electronic financial transactions are expected to account for half of all transactions made within the next three years.

“In terms of volume, financial transactions done electronically jumped from 1% of the total in 2013 to 10% in 2018. In terms of value, financial transactions done electronically surged from 8% to 20% of the total over the same period,” he told guests. “With the present trajectory, we are confident that the volume of financial transactions will hit or surpass the target of 20% of the total in 2020 and reach 50% by the end of 2023.”

Governor Diokno also outlined BSP’scommitment to making the country’s payments system interoperable and promoting digital payment solutions.

“We launched EGov Pay, which will allow more government agencies, such as, for example, the Bureau of Internal Revenue, to accept electronic payments from the public,” he said. “We also launched the National QR Code Standard, which will pave the way for more extensive use of QR codes as payments. In the future, we hope to see market vendors, tricycle and taxi drivers, and sari-sari store owners, among others, using QR codes as a means to accept payments.”

Speaking on the BSP’s initiatives, Atty. Alejandro Navarro remarked, “The convenience in using our mobile devices for the payment of goods and services, utilizing alternative lending platforms to finance businesses, and the rise of virtual currencies and cryptocurrency as a new medium of exchange have dramatically changed the financial environment. These changes and the paradigm shifts driving them now bring about the corresponding challenge to maintain security and stability of the Philippine banking system and monetary policy as a whole.”

Commenting after the event, Cooke said that BSP’s bid to create an efficient payments and settlements system as part ofits broader bid to expand financial inclusion is a key focus of OBG’s research on the Philippines’ economy and a topic that will undoubtedly be of interest to investors keen to learn more about the country’s bright outlook, which includes targeted growth of 6.5% this year, up from 5.9% in 2019.

“Digitalisation is advancing on several levels across financial services in the Philippines, from take-up amongst corporations to the growing number of merchants utilising the retail payment system InstaPay,” he said. “Bangko Sentral ng Pilipinas has a key role to play in creating the ecosystem required to encourage more businesses to pursue digital transformation policies. I’m delighted that our event provided Governor Diokno with a timely opportunity to share his thoughts on this important topic and look forward to exploring it further in our coverage of the Philippines’ economy.”

Click here to subscribe to Oxford Business Group’s latest content: http://www.oxfordbusinessgroup.com/country-reports

About Oxford Business Group

Oxford Business Group (OBG) is a global research and advisory company with a presence in over 30 countries, from Asia, the Middle East and Africa to the Americas. OBG is a distinctive and respected provider of on-the-ground intelligence on the world’s fastest growing markets for sound investment opportunities and business decisions.

Through its range of products – Economic News and Views; The OBG CEO Survey; OBG Events and Conferences; Global Platform, which hosts exclusive video interviews; The Report publications – and its Consultancy division, OBG offers comprehensive and accurate analysis of macroeconomic and sectoral developments.

OBG provides business intelligence to its subscribers through multiple platforms, including its subscribers, CNKI, Dow Jones Factiva subscribers, the Bloomberg Professional Services’ subscribers, Refinitiv’s (previously Thomson Reuters) Eikon subscribers, and more.